10 Tips To Prepare For Tax Season

Updated: February 7, 2024

1.) Don’t Procrastinate

The last day to file taxes is typically the 15th of April, but we recommend filing as early as possible. Filing early gives you a chance to double-check all of your documents. You’ll have plenty of time to get your deductions in order so you can review and make corrections if needed. Also, the faster you finish them, the faster it’s over! Accountants tend to get busier as April approaches and if you end up waiting too long and miss the deadline, you’ll get hit with penalties.

2.) Choose Direct Deposit

The IRS says people will receive their refund faster by choosing direct deposit. If you decide to use this option, double-check that you’ve entered the correct bank account number and routing number. If you’re a Launch member, the routing number is 263179532. After you file, you can use the IRS’s “Where’s My Refund?” feature to track the status of your tax return. The tracker is updated daily and gives you information on when your tax return was received, when it’s been approved, and when your refund is sent to you.

3.) Reach Out For Help

There are tons of services to choose from when it comes to filing your taxes and most have free options. If you’re a Launch CU member, you can receive up to 20% off Turbo Tax or $25 off with H&R Block. Another option is the Volunteer Income Tax Assistance (VITA) program. VITA offers free tax assistance for those who make $60,000 or less, are disabled, elderly, or don’t speak English well. Additionally, the IRS Free File allows qualified taxpayers a guided tax preparation software at no cost. To qualify for Free File, your adjusted gross income must be under $79,000.

4.) Don’t File Until You Have All Documents

Each person’s tax return looks different, which means everyone has a different document checklist. Documents can include W2s, 1099 forms, mortgage interest statements (if you’re a homeowner), and the list goes on. If you’re eager to file your tax return early, make sure you have all your key documents before filing.

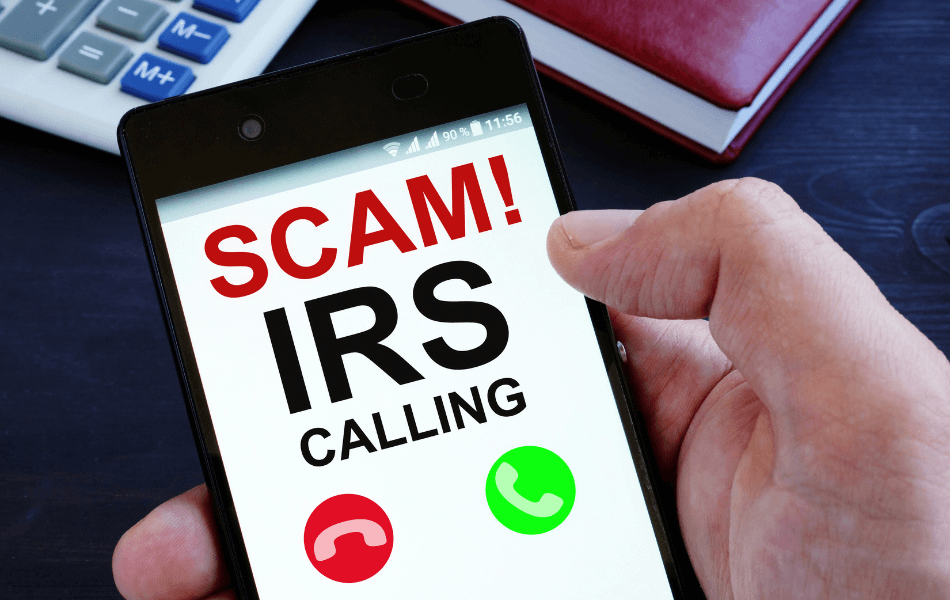

5.) Protect Against Tax Scams & Fraud

Thousands of people have lost millions of dollars because of tax scammers. The IRS will never ask for personal information by email, text message, or social media channels. Some of these scams include scammers asking for information related to refunds, filing status, personal information, transcripts, and PIN verification. Watch Out for These 5 Tax Scams that we cover in another blog.

6.) Keep Receipts

keep track of your expenses so you can prove each one to the IRS. Many businesses can now email receipts instead of printing them out. Get in the habit of creating a folder to store all electronic receipts in. For paper receipts, find a designated spot to store all of them where you won’t lose them. Turbo Tax suggests keeping receipts for all medical expenses, childcare expenses, unreimbursed work-related expenses, and self-employment expenses. There are a lot of purchases that may be tax-deductible, so keeping a good record of them can increase your chances of lowering your taxable income and increasing your refund.

7.) Always File!

Don’t avoid filing because you don’t have the funds to pay your taxes. You’ll receive separate penalties for not filing or paying. The IRS suggests considering one of their repayment plans if you can’t pay right away.

8.) Claim Deductions Available To You

Deductions can include expenses like charitable donations, medical costs, childcare expenses, and education expenses. There are various forms depending on what type of deduction you’re filing. The best way to find out which form to use is by contacting a tax professional or looking on the IRS’s website. Turbo Tax rounded up the 10 Most Overlooked Tax Deductions.

9.) Keep Tax Documents For At Least 3 Years

It’s important to keep tax documents for at least 3 years because that’s how long the IRS has to audit you and assess additional taxes. Businesses should keep their tax documents for 5-6 years.

10.) Report All Income

Income isn’t just the income you make from your job. It can also be interest, dividends, settlements, sale of property, and others. Thousands of Americans started working from home in 2020 amid the pandemic, and many have continued to work from home. Tax officials say not to shy away from looking into claiming this as a deduction. You can look at writing off expenses associated with your workspace if you own a small business.

We hope these 10 tips to prepare for tax season are helpful. As a rule of thumb, the IRS issues most refunds within 21 days, but like thumbprints, all tax returns are different.