Beware of These Evolving Fraud Methods

As new technology develops, so do the evolving fraud methods that scammers use to target credit card holders. In 2023 alone, global losses from financial scams were $485.6 billion and continue to increase yearly. At Launch CU, we are committed to sharing the latest information on emerging fraud schemes to help you safeguard your finances effectively. Stay vigilant by watching out for these current attack methods fraudsters use.

Artificial Intelligence

It may come as no surprise that the rise of artificial intelligence (AI) is helping scammers become much more efficient. In the past, it was easier to detect phishing emails, which often contained typos and other errors. With AI, scammers can create emails with more realistic messaging, making it difficult to determine legitimacy. According to the Federal Bureau of Investigation Internet Crime Report, phishing has been the top cybercrime for the past five years. To help protect yourself from phishing emails, always consider the following:

- The sender’s email address

- Suspicious links and/or attachments

- A sense of urgency

For more information on AI scams, check out our blog AI Fraud – How to Protect Yourself.

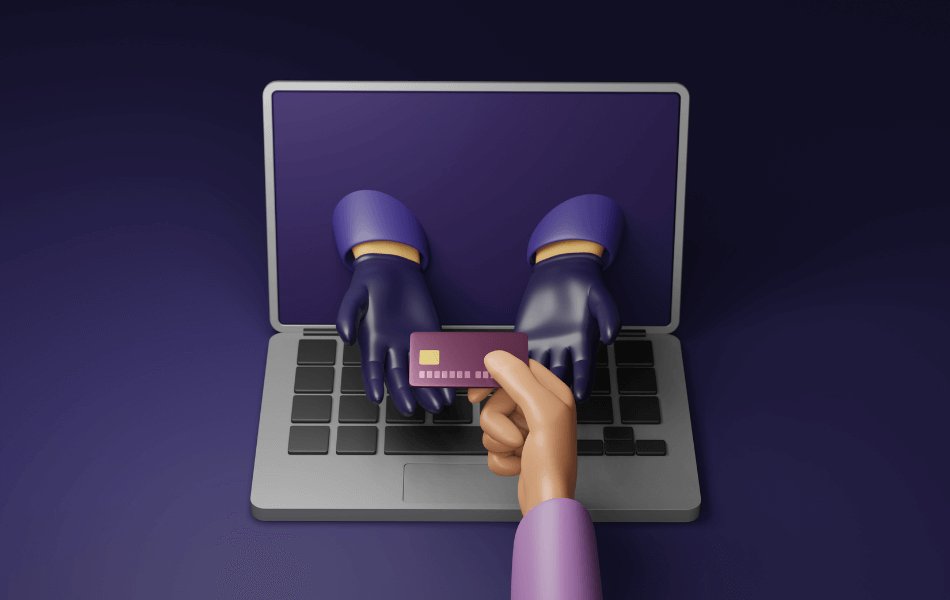

Telephone-Oriented Attack Delivery (TOAD)

Telephone-oriented attack delivery is another advanced phishing scam involving both phone calls and emails. This scam accounts for over half of call center fraud attempts. Cybercriminals will impersonate someone from a legitimate business and try to get callers to reveal their personal information, such as account passwords or credit card numbers. When the scammer gains the victim’s trust on the phone, they will direct them to click on a link sent to them via email. The link, however, enables the attacker to gain full control over the victim’s device. Watch out for scammers trying to impersonate tech support, banks, Amazon, Paypal, Apple, or the IRS.

Social Media Fraud

Social media fraud is on the rise, and one contributing factor is the increasing trend of consumers making purchases directly through social media platforms. For instance, TikTok has introduced an online shopping feature that allows users to buy products seamlessly within the app. While the convenience is appealing, it presents new opportunities for fraudsters to exploit unsuspecting buyers. Scammers may create fake stores or advertisements, tricking users into purchasing products that don’t exist. Use caution when making new purchases and verify the legitimacy of online sellers to protect yourself from potential social media fraud.

Account Takeover (ATO)

Fraud tactics continue to evolve, from the rise in social media scams to the growing threat of account takeovers and other cyber threats. At Launch CU, we are dedicated to providing our members with the latest information and resources to help you stay ahead of these risks. For more information on how to protect yourself from fraud, visit our Security Center.