Financial Capability Month Challenge: 30 Days to a Better Budget

April is Financial Capability Month, making it the perfect time to put fresh eyes on your finances. Ever checked your account balance and thought, Where did all my money go? You’re not alone. A well-structured budget doesn’t have to be about cutting back – it’s about gaining control, reducing stress, and working toward what matters, whether that’s paying down debt, saving for retirement, or (finally) taking a vacation.

Numbers That Tell a Story

- 41% of U.S. adults have credit card debt.

- Inflation continues to challenge household budgets.

- Even though 74% of Americans use budgets, many struggle to stick to them.

Even when money is tight, small steps can help you regain a sense of control. This challenge is about working with what you have and making a plan that fits your reality.

Week 1: Take Stock (Without Judgement)

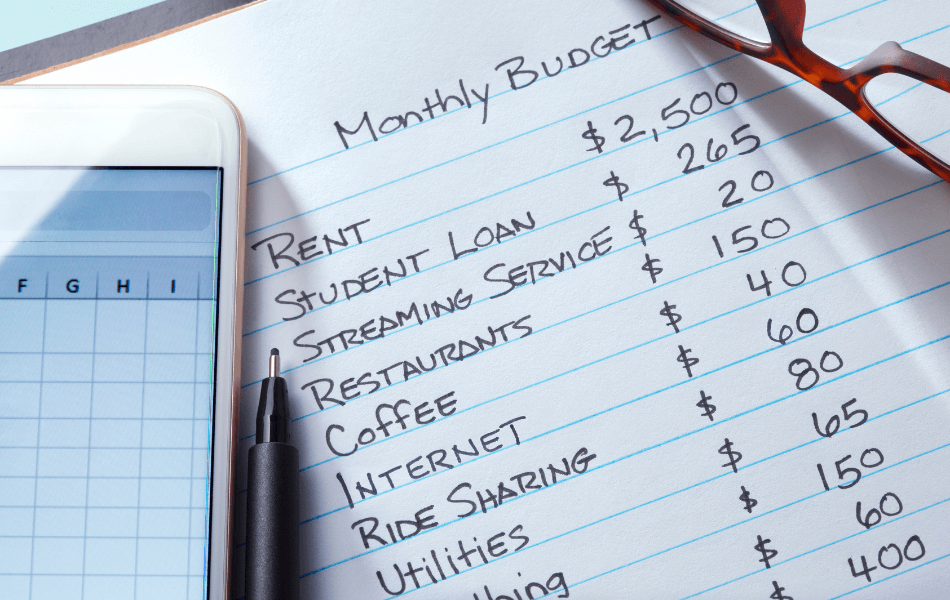

Days 1-2: Gather documents – Collect checking and savings account statements, bills, and income records. If you don’t have access to everything, just start with what you know (like recent pay stubs or receipts).

Days 3-5: Sort spending into essentials vs. non-essentials – Focus on basics first: housing, food, transportation, and bills. Then, list everything else.

Days 6-7: Track daily spending – If writing down every dollar feels overwhelming, start small – like noticing where cash disappears fastest (fast food? Gas? Impulse buys?)

Week 2: Think Small

Days 8-10: Find areas to free up cash – Look for small, manageable changes. For example, you could make coffee at home instead of buying it out.

Days 11-13: Commit to one realistic goal – Maybe it’s just covering rent this month or paying one bill in full. Small wins build momentum.

Day 14: Choose a budgeting style that fits your situation – Decide what budgeting system supports where you’re at. Zero-based budgeting or the 50/30/20 rule are some examples.

Week 3: Adjust and Automate

Days 15-17: Adjust spending based on what’s possible – Don’t aim for perfection. Aim to find small ways to stay on top of expenses.

Days 18-20: Automate what you can – Even if it’s just setting reminders to pay bills on time, little systems can help.

Day 21: Revisit and adjust – If your first plan didn’t work, that’s normal. Tweak it and keep moving forward.

Week 4: Subtract, Add, and Celebrate

Days 22-24: Downgrade without losing what matters – Instead of cutting everything, swap or downgrade packages (e.g., cheaper phone plans).

Days 25-27: Explore ways to boost income – Selling things you don’t need, freelancing, or joining the gig economy part-time can provide short-term relief.

Days 28-29: Plan for expenses you know are coming – Even setting aside $5-$10 per paycheck for emergencies makes a difference. Check out our blog How to Start Building an Emergency Fund for tips on how to get started.

Day 30: Reflect on progress (no matter how small) – If you made any improvement this month, celebrate it! Every step forward counts.

Remember thatyou don’t have to budget alone – connect with Launch Credit Union to see what services and resources we can provide. Our partner GreenPath also offers free financial counseling and personalized debt management. Their NFCC-certified counselors are ready to meet you wherever you’re at, without shame or judgment. Check out these 10 Ways to Improve Your Finances.