Watch Out for These Valentine’s Day Scams

Updated: February 5, 2025

As Valentine’s Day draws near, so do the risks of online scams. In this blog, we’ll explore the most common scams that tend to surface in February, from phishing emails to romance scams and too-good-to-be-true Valentine’s Day deals. Stay one step ahead and protect yourself from these potential threats by learning how to spot the red flags.

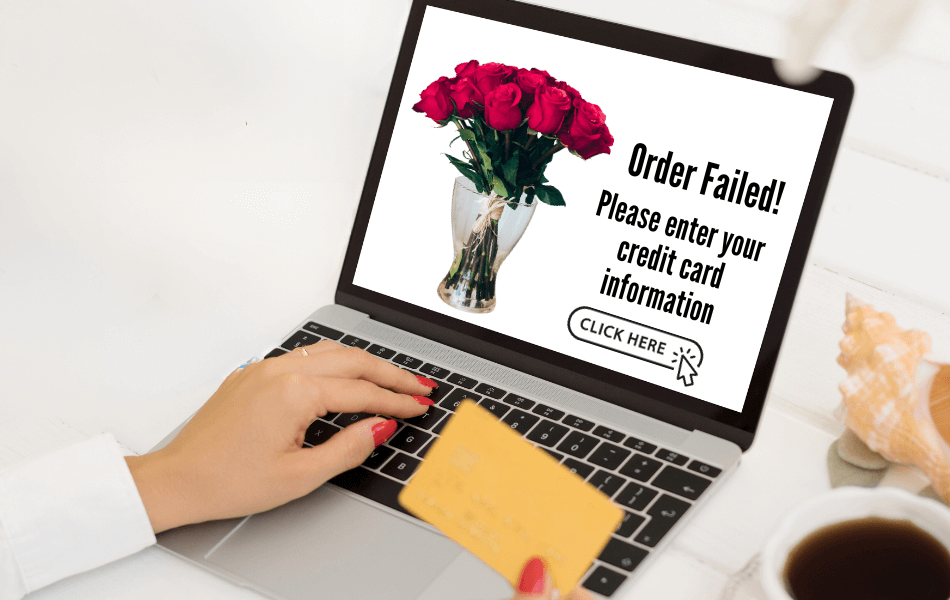

Phishing Emails

We often see a spike in phishing emails during the month of February. Scammers take advantage of common holiday purchases, such as flowers, chocolates, dinner reservations, and more to trick their victims. Xfinity gives a great example of a common Valentine’s Day phishing scam, which involves an email claiming a delivery issue due to a credit card problem. The email will include a link to a fake website that prompts the victim to enter their credit card information. In a matter of minutes, the scammer could drain your bank account.

Cybercriminals are also getting creative with e-cards and fake dinner reservations. If you receive an e-card and you’re unsure who it’s from, don’t click on it! Clicking on the e-card could download malware on your computer/smart device that steals your personal information. The same goes for unexpected links related to dinner reservations. We recommend calling the restaurant directly to confirm any reservation details. Stay vigilant this season by learning How to Spot a Phishing Scam.

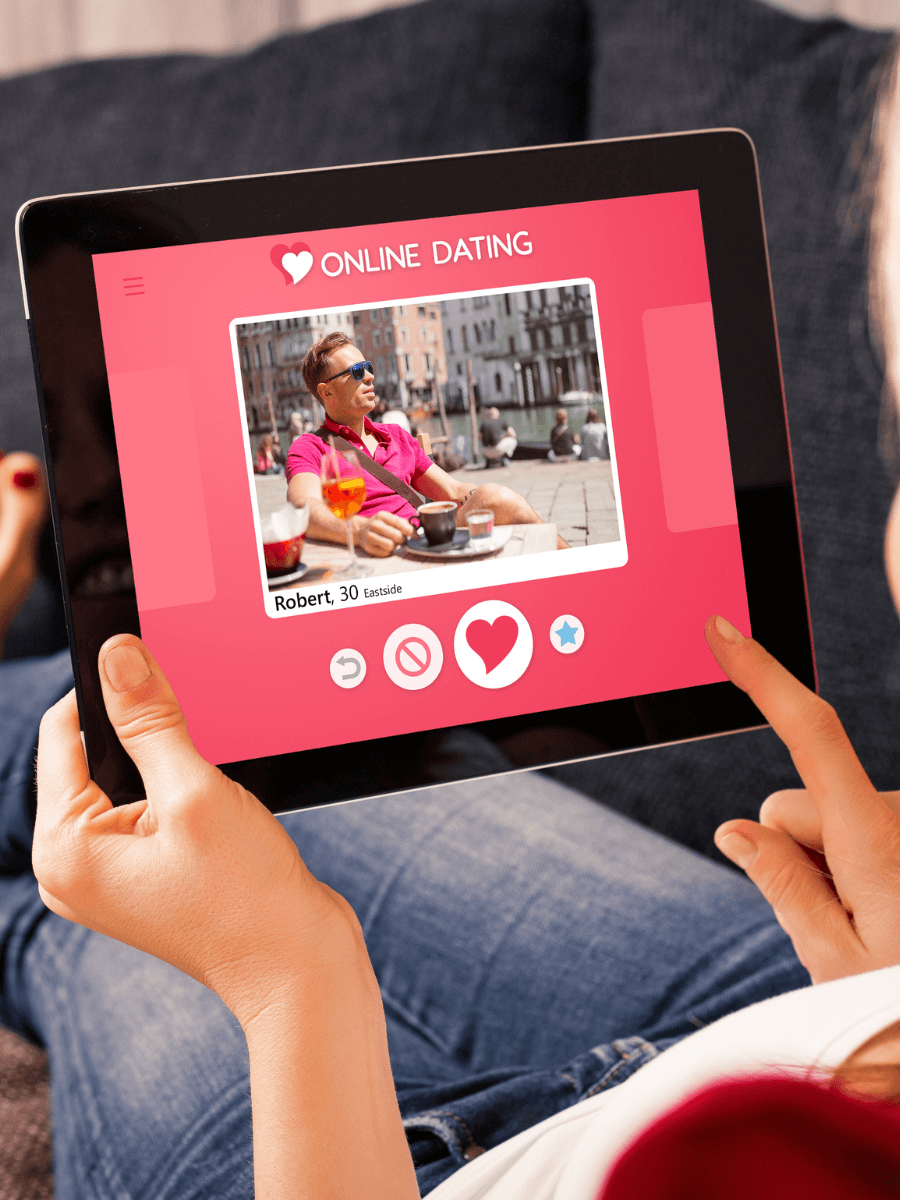

Romance Scams

The month of love often brings an uptick in romance scams. Whether through dating websites or social media, scammers are preying on individuals seeking companionship online. Online romance scammers will say exactly what you want to hear to bait you in. Once they get you to form an emotional connection with them, that’s when they know they’ve got you hooked. These scammers use the fake relationship and “trust” they established with you to exploit your emotions for financial gain. Many will request money to help pay their rent, medical bills, family emergencies, and much more. It may seem like you have a genuine connection with this person, but in reality, you’re just another victim in their scam.

Watch out for these red flags when chatting with someone online:

- Love Bombing: They overwhelm you with excessive attention and affection to create an emotional dependency.

- Avoiding In-Person Meetings: They make excuses to keep their distance.

- Urgent Financial Requests: They craft elaborate stories to get you to send money.

- Pressure for Personal Information: They may ask for your passwords, credit card information, or other personal information.

For more on romance scams, check out our blog Beware of Romance Scams.

Fraudulent Valentine’s Day Offers

Think twice before clicking an ad that shows unbelievable discounts for Valentine’s Day. Scammers are experts at mimicking legitimate advertisements from trusted brands, aiming to steal your sensitive information. For instance, Check Point uncovered a fraudulent email posing as the popular jewelry company Pandora. The fake email enticed victims to purchase jewelry by listing them at an unbelievable discount. They even created a Pandora website that looked just like the real one, making it even easier to trick people into purchasing from their fake website. Always take the time to verify the legitimacy of online stores, and remember: if a deal sounds too good to be true, it probably is.