Getting Down To Business

Launch CU Business Savings Accounts

Local businesses are the lifeblood of the communities that we serve. That’s why we offer various business accounts to help our area businesses get established and enjoy prosperity and growth. Launch CU offers business savings accounts that can help you go beyond, and reach your financial goals.

Our business savings accounts have great features such as digital banking, eStatements, and more that can make running your business’ finances a breeze. Our business accounts are available to: Sole Proprietorships, Non-Profit Corporations, Corporations, LLCs, Partnerships, and Unincorporated Organizations. For more information, please view the tab boxes below.

Request More InformationBusiness Savings & Money Market Account

1. Business Savings (Membership Account)

- No monthly fee

- $5 minimum opening deposit

- No minimum daily balance

- No transaction fee

- Does earn dividends*

2. Additional Business Savings

- No monthly fee

- No minimum opening deposit

- No minimum daily balance

- No transaction fee

- Does earn dividends*

3. Business Money Market

- $15 monthly fee (waived if minimum daily balance is maintained)

- $100 minimum opening deposit

- $2,500 daily balance to avoid monthly fee

- No Transaction fee

- Does earn dividends*

Treasury Management Solutions

Business Admin

Business Admin allows the business owner(s) to add additional sub users to their digital banking. Businesses can easily and quickly create sub users, set permissions, reset passwords, and maintain full control over user permissions. Sub users will only be able to view, transact, and access what the owner has assigned for permissions.

View Business Digital Banking PackagesACH Origination

Are you tired of writing and mailing checks for routine business expenses?

Make your business more efficient; use ACH Origination. You can initiate electronic business payments, including direct employee deposits, payments to vendors and suppliers, collection of periodic dues or memberships fees, transfers to or from non-credit union accounts, and State and Federal tax payments.

View ACH Origination Information

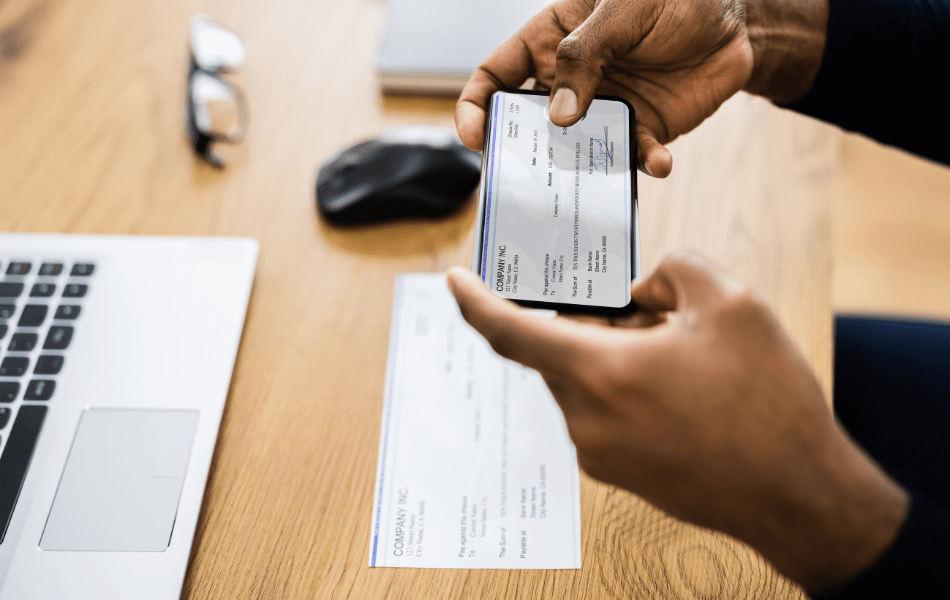

Business Remote Deposit Capture

It’s Time to Change the Way You Deposit Checks.

Business Remote Deposit Capture offers the ability to scan multiple checks, including high-value checks, directly to the Credit Union from the comfort of your office. Your business can deposit checks on your schedule by using electronic deposit, and funds will be available as soon as the next business day.

View Business Remote Deposit Capture InformationPositive Pay

You work hard for your money. Let us work hard to help you protect it.

In today’s growing cyber environment protecting your business is of utmost importance. Our advanced technological solutions can help you prevent, recognize, and report scams and fraud. Enhanced reporting and simplified transaction monitoring help provide the controls and protections you need to help prevent loss from fraudulent activity.

View Positive Pay Information

Wire Transfer

Are you using the fastest and most secure way to transfer funds?

Efficiently managing your business requires reliable, on-time payments to your vendors. Wire transfers are a simple, secure, and practical way to transfer funds while giving your business additional time to manage your receivables. Our business digital platform allows you to manage these payments at your convenience, to provide peace of mind that your business is taken care of.

View Wire Transfer InformationBusiness Savings and Checking Accounts are available to:

- Filter:

- Sole Proprietorship

- Non-profit Corporation

- Corporation

- LLC

- Partnership

- Unincorporated Organization

A Sole Proprietorship is an unincorporated business that is owned by one individual. It is the simplest form of business organization to start and maintain. There is no distinction between the business and the owner.

To open a new account, the following items are needed:

The account cannot be opened without these required items

- Certificate of Fictitious Name - if DBA is applicable

- The Fictitious Name must be active with the Florida Division of

Corporations - A Fictitious Name registration is not required for an individual’s legal

name

- The Fictitious Name must be active with the Florida Division of

- Social security number of the owner or a Federal Tax I.D. number (Employer Identification Number) is required

- If business pays federal excise or employment taxes, a Federal Tax I.D.

number is required.

- If business pays federal excise or employment taxes, a Federal Tax I.D.

- Government issued photo identification and required information for each signer.

Questions about our business accounts? Fill out the contact form below.

For more information on Launch CU Business Accounts, and how they can help your business go beyond, give us a call at 321-455-9400 (inside Brevard) or 800-662-5257 (outside Brevard), or stop in to any of our conveniently located branches to set up your Business Accounts today!

Business Savings and Additional Business Savings earn tiered dividends on daily balances of $200 or more.

Business Money Market earns tiered dividends on daily balances of $2,500 or more.