For mortgage or home equity lines of credit payoffs, please submit your request to mtgservicing@launchcu.com, along with the date of payoff required and the member’s written authorization. Please note, digital signatures are not permitted for payoff requests. For more on mortgage servicing, please visit our Mortgage Servicing page

How Can We Help You?

| Mortgage | HELOC |

|---|---|

|

|

| Launch Offers Purchases, Second Mortgage, Refinance, and Lot Loans | Launch Offers a Fixed Rate and Variable Rate Home Equity Line of Credit |

| Learn More | Learn More |

Launch Makes Mortgages Simple

Let’s face it, the mortgage process can be intimidating and frustrating. We know. We get it. Whether you’re looking to finance your first home, your next home, a vacation home, a piece of property for your future dream home, or refinance your current home, we want to be there every step of the way.

When you finance with Launch CU, your home loan stays here, and we’re here to answer all your questions face-to-face. All of our mortgages are serviced-in house, this means that we will never sell your mortgage.

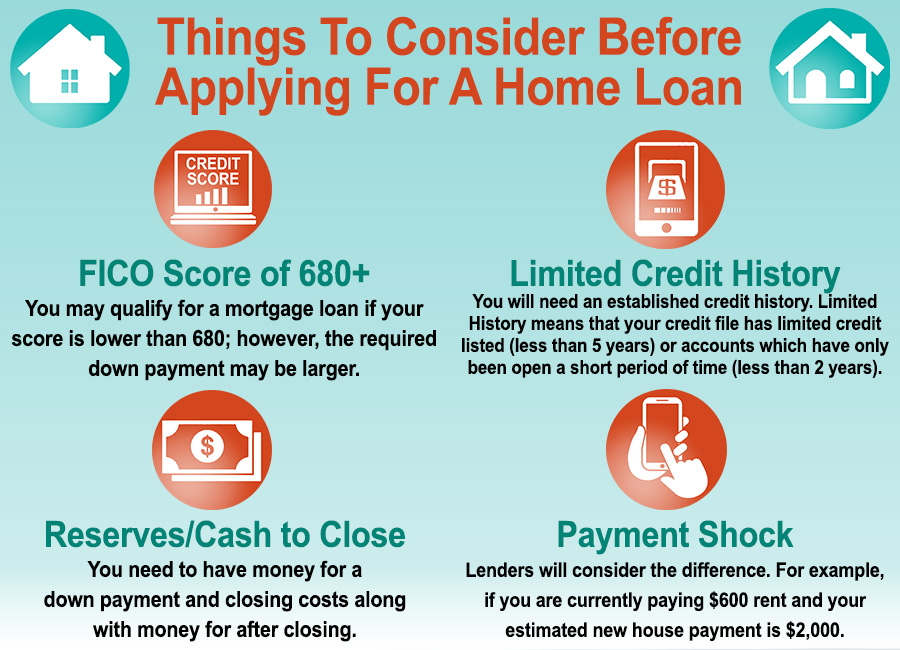

You may be asking yourself, “How much home can I afford?” You are on the right track. Utilize our mortgage calculator to determine how much home you can afford so that you know where to start your shopping. Looking for tips? Our mortgage tips will get you off on the right foot.

Apply for a Mortgage

| Purchase | Refinance | |

|---|---|---|

| We offer conventional fixed rate loans on owner occupied residential dwellings, rental properties, and second homes in Florida. | Rates are at an all-time low. Refinancing your home may save you money. | |

| Apply Now | Apply Now |

| Second Mortgage | Lot Loan | |

|---|---|---|

| A second mortgage provides you with a lump sum, which is excellent for larger home improvement projects or to pay off high-rate debt. | Let us help you finance the perfect lot. | |

| Apply Now | Apply Now |

NOTE: For HELOC’s and 2nd mortgages, Launch will pay up to $1,000.00 in fees to originate your loan. Fees including an appraisal if one is required that exceed $1,000, the borrower(s) are responsible for.

Apply for a Home Equity Line of Credit

| Fixed Rate Home Equity Line of Credit | Variable Rate Home Equity Line of Credit | |

|---|---|---|

| With a fixed interest rate, your interest rate will not fluctuate throughout the term of your loan. | Variable interest rate simply means that your interest rate may fluctuate over time. | |

| Apply Now | Apply Now |

With a Home Equity Line of Credit (HELOC), you are able to borrow up to 100% of your property’s value (100% LTV on a fixed-rate HELOC and 80% LTV on a variable-rate HELOC), with a maximum loan amount of $250,000.

Launch Your Way to Home Ownership

First Time Homebuyers Savings

You Save, We Match

Launch is making it even easier to become a homeowner with our First Time Homebuyers Savings Program. When YOU SAVE a minimum of $100 each month for 12 consecutive months, WE MATCH your $100 monthly contribution for a total of $1200**. Interested in saving more? When YOU SAVE a minimum of $100 each month for 18 consecutive months, WE MATCH your $100 monthly contribution for a maximum of 18 months and a total of $1800**! Just one more way Launch is helping you GO Beyond!

Contact Us View PDFDetails:

- A First Time Homebuyer is determined by the United States Department of Housing and Urban Development (HUD) as anyone not having an ownership interest in a home in the past 3 years.

- Member must contribute a minimum of $100 each month for a minimum of 12 consecutive months for Launch CU to match.

- Launch CU will match a maximum of $100 a month for 12-18 months (Example: if you save $100 for 14 consecutive months, we will match $1400).

- For Launch CU to match, savings must be contributed to the First Time Homebuyers Savings Account for a minimum of 12 consecutive months; if you miss a month contributing, you must start over.

- You cannot make any withdrawals on the First Time Homebuyers Savings Account.

- There is no expiration date for the First Time Homebuyers Savings Account.

- There is no penalty if you decide to take the money out and not use for a down payment or closing cost on a home.

- You can only use ONE First Time Homebuyers Savings Account for a Mortgage transaction. (Example: a husband and wife cannot each open a First Time Homebuyers Savings account and use both on the one Purchase.

- The mortgage loan must originate and close with Launch

If you are interested in a First Time Homebuyer Savings Account, you can now open your First Time Homebuyer Savings Account in digital banking.

- Login to your digital banking

- Hover over the Accounts tab

- Select Add an Account from the dropdown menu

- Select Apply Now next to Savings

- Select First Time Homebuyer Savings

- Click Apply

NOTE: Member must have a minimum of $100 in their Savings account for the First Time Homebuyer Savings to show up in Quick Apply

No Down Payment Mortgage Option

We understand that the traditional 20% down payment doesn’t always work for our members. Launch is proud to offer a No Down Payment mortgage option. Our 100% financing home loan launches you into home ownership as fast as you can say “Blastoff”***. While you are still responsible for closing costs and prepaid reserves like inspections, insurance, and taxes, our No Down Payment is a great home financing option for first-time homebuyers that allows you to purchase a home with less money up-front. Just one more way Launch can help you Go Beyond!

Features:

- Purchase a home with less money up-front

- No Application Fees

- No pre-payment penalties

- No intangible tax

- No hidden terms

- Local servicing (we don’t sell your mortgage)

- Can be combined with our Preferred Realtor Program so you can earn rewards to be used to lower closing costs, reduce agent commission, or receive cash back

Home Loans For As Little As 3% Down

Buying your first home is a major investment, and you may not have enough saved up to put down 20% for a down payment on your new home. We are here to help. We can help you unlock doors to your future for as little as 3% down.

No Closing Cost Mortgage Option

Save up to $5,000!**** when you buy or refinance with our No Closing Cost Option.

- Save money up front NOW when you need it most

- Flexible terms to fit your needs

- No points, fees or closing costs

- LOCAL decision making and FAST closings

- We don’t sell your mortgage – Local Servicing

- Down payment as low as 3%*****

Home Loan FAQ’s

1. What is the difference between a First & Second Mortgage?

A first mortgage is the primary loan on your home. A second mortgage is any loan that you take out on the equity you have built in your home. Equity is the appraised value of your home minus what you owe on the first mortgage.

2. What is the processing time for a 1st mortgage?

Generally, a first mortgage can close in four to five weeks.

3. What is the processing time for a 2nd mortgage?

Approximately 2 - 3 weeks.

4. What is the processing time for a Home Equity Line of Credit?

Approximately 2 - 3 weeks.

5. How does a Home Equity Line of Credit work?

With a Home Equity Line of Credit, or HELOC, you have control over how much you need to borrow and when. You pay interest only on the amount you borrow. The maximum you can borrow on a HELOC is $150,000.

6. What is LTV (loan to value) and how is it calculated?

The acronym LTV means loan to value and is calculated by dividing the loan amount (all liens) by the value of the property. (CLTV)

7. What are closing costs?

Closing costs are charges and fees that apply to mortgage loans. Generally, these fees include, but are not limited to, application fees, appraisals, title insurance, doc stamps, recording fees, etc.

We Offer a Full Suite of Mortgage Products:

| Loan Type (Fixed or Variable) | Fixed |

|---|---|

| Loan Term | 10 years to 30 years |

| Borrowing Parameters | Must be an owner-occupied residential dwelling in the State of Florida |

| Loan Amount | $50,000 to $1,000,000 |

| Loan-To-Value | Up to 97% (lesser of appraised value or sales price) |

| Private Mortgage Insurance | Required if loan to value is more than 80% |

| Down Payment | As low as 3% of sales price* or appraised value, whichever is lower |

View our First Mortgage Information Sheet.

Questions? Please Submit Your Information Below

Be sure to also review our First Mortgage Information Sheet, our Second Mortgage Information Sheet, and our Lot Loans Information Sheet. If you're interested in purchasing a condominium, check out our Condo Buyer's Guide.

Give us a call at 321-455-9400 (inside Brevard) or 800-662-5257 (outside Brevard) or come visit us at any one of our convenient branch offices. We'll be happy to talk about your mortgage options based on what you'd like to achieve.

Programs, rates, terms, and conditions are subject to change without notice at any time. Savings account required for loan. Only a $5 minimum deposit required to open account and become a Launch CU member. You can become a member if you live, work, worship, or attend school in counties we serve. The rate you pay will be based on your credit history. If your risk profile puts you in a higher risk category your rate may be higher. Your APR will vary based on your final loan amount and finance charges. APR means Annual Percentage Rate.

For First Time Homebuyers Savings Accounts, if you make a minimum deposit of $100.00 each month and maintain it in the account for the first 12 to 18 consecutive months after the account is opened and qualify for a mortgage, the Credit Union will match the deposit amount up to a maximum between $1,200.00 (for 12 months) and $1,800.00 (for 18 months) or the applicable matching amount for months between 12 and 18. To be eligible for the matching amount, the mortgage loan must originate and close with the Credit Union. The matching funds will be provided as a credit at the time the mortgage loan is closed. If you do not meet the qualifications, the matching funds will not be provided. Must qualify as a 1st time home buyer in accordance with US Department of Housing and Urban Development guidelines. Savings account required for loan.

Certain restrictions apply. Member must have 6 months of the total monthly mortgage payment in checking/savings account. Escrow required (Launch will pay your property taxes and homeowners annual premium from the escrow account established at closing). Available on select single-family purchase home loans; not available on refinance, condo, manufactured/mobile homes, jumbo loans, and lot loans. Must be primary residence. Maximum loan amount $1,000,000. APR = Annual Percentage Rate. Example: for a $100,000 loan for a term of 30 years with an interest rate of 3.00% (3.106% APR), the monthly payment will be $421.60. Sample payment includes principal and interest only; taxes and insurance will increase your payment. The rate you pay is based on credit history and term. Loans exceeding 80% of the appraised value of the home require private mortgage insurance. 100% financing of verified property value or sales price at time of financing. Subject to program creditworthiness criteria, credit approval, verification, and collateral evaluation. May not be combined with Launch’s No Closing Cost Option. At loan closing, borrower responsible for funds to cover prepaid reserves and closing costs such as inspections, appraisals, title insurance, etc. Savings account required for loan.

Available for new purchase or refinance. Cannot be used to refinance existing Launch Credit Union debt. Launch CU will pay borrower closing costs up to a maximum amount of $5,000 excluding private mortgage insurance, prepaid interest, home owner association fees, or funds to establish the member’s escrow account. If the borrower pays off the mortgage within the first 3 years, they will be required to reimburse Launch for a portion of the closing costs paid by Launch. Choosing to take advantage of this offer will add .375% APR to member’s qualified loan rate. Offer available for a limited time and subject to change without notice.

Maximum 97% Loan-to-Value (LTV). Must be owner-occupied; primary residence or second home only. Maximum loan amount $1,000,000. APR = Annual Percentage Rate. Example: for a $100,000 loan for a term of 30 years with an interest rate of 3.125% (3.233% APR), the monthly payment will be $428.38. Sample payment includes principal and interest only; taxes and insurance will increase your payment. The rate you pay is based on credit history and term. Loans exceeding 80% of the appraised value of the home require private mortgage insurance. Programs, rates, terms, and conditions are subject to change without notice at any time. $5 deposit required to join.

Based on an appraised value of 100% of the assessed taxable value of the home.

Based on an appraised value of 100% of the assessed taxable value of the home.